Maybe its time for us to look at the problem as an opportunity and to capitalize on the uncertainty that’s inherent and that’s probably never going away.

-D. Scott Bloom, CFP

CERTIFIED FINANCIAL PLANNER™

|

How Much Do We Really “Know”? Isn’t Information the same thing as “knowledge”?

Having an abundance of information available to us has very little to do with being knowledgeable about anything. If you think about it, that’s a very bold statement to make. Doesn’t information lead us to knowledge automatically? No it doesn’t. And I think many people, if not most people, are confusing the two. Here’s an example. Let's say you’re about to take your first shot at building your own home all by yourself. Now you have a choice of reading a book on the subject or not reading a book on the subject. Obviously having the book is helpful, but you still don’t know anything about building your own home until after you’ve done it. In other words, you’re no more knowledgeable about building a house after having read the book. The same holds true with financial books and financial media. Just because you have the information available doesn’t make you any more knowledgeable, experienced or capable than the next person. This is something I help my clients with. -D. Scott Bloom, CFP The opinions voiced in this material are for general information only and are not intended to provide specific investment advice or recommendation for any individual. To determine which investment(s) may be appropriate consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly. LPL FINANCIAL Member FINRA / SIPC The Law of supply and demand will save us from doom if not at least help us understand why consumption matters so much to the economy and its general health. This is an iScott truism.

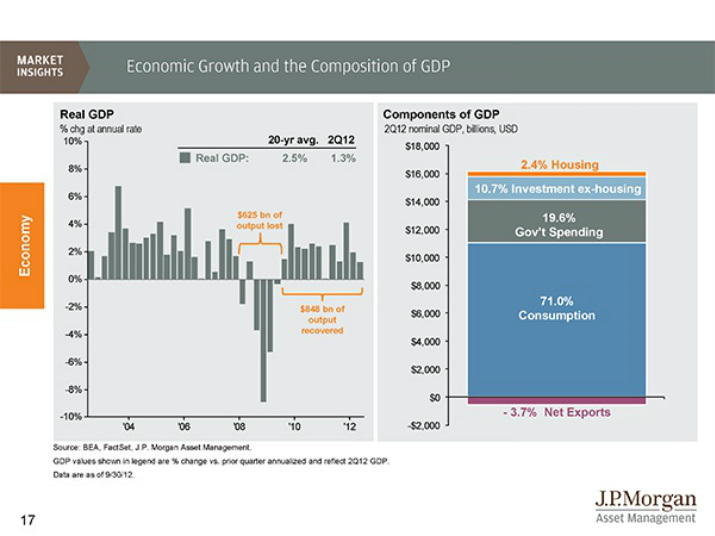

There is a widespread debate happening in this country which paints a very dire and gloomy picture for our future, mostly blaming ‘out-of-control’ spending and an overly-politicized “fiscal cliff”. While we dohave a chronic accounting problem with our government, it is not the crisis so many are claiming. We, as consumers, account for 71% of the US economy1. That means all of the energy, food and discretionary items we ‘demand’ for our lives is meaningful in comparison to the “demands” of the US Treasury. Total federal spending (including defense and entitlements) accounts for 19.6% of our economy. While this number has grown from the mid-teens in the past two decades, it is still dwarfed by “our” number (71%). We outspend the government by more than 3-1. That puts us in the lead and makes us the driver of economic growth. Amateur economists an pessimists alike will find every reason to compel us to believe that the government’s problem sends our economy off a sudden cliff. iScott contends they are misguided. Instead, the government’s accounting problem simply flattens our inherently sloped growth trajectory, if not turning it slightly downward on an intermediate term basis. iScott.net is designed to provide interested readers with alternate perspectives of mainstream media’s agenda. -D. Scott Bloom, CFP ® CERTIFIED FINANCIAL PLANNER™ LPL Financial Member FINRA / SIPC 1 Sources: Bureau of Economic Analysis, FACTSET, JP Morgan Asset Management GDP values shown in legend are % change vs. prior quarter annualized and reflect 2Q12 GDP. The opinions voiced in this material are for general information purposes only and not intended to provide specific investment advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful. Here’s what you can do about the “Fiscal Cliff”:

Nothing. You are powerless in the hysteria of the so-called “Fiscal Cliff”, the media’s catchphrase du jour ever so reminiscent of Y2K, H1N1, Avian, SARS, etc, etc. So what will happen when we go off the cliff on January 1? Nothing, absolutely nothing is going to happen except Rose Parade, football and guacamole. Conversely, we have already paid growth penalties in the form of uncertainty and frozen capital; the markets are discounted accordingly. In 2013 we will see economic hindrance passed downward to the end user, call these affects “trickle-down taxes” and they are on top of any other tax consequences being erroneously touted as economic stimulus by the current admin. What you CAN do, however, is prevent your own fiscal cliff (ditch, ledge or curb). You do this by learning from an inefficient and non-cooperative government. Heed the lessons of basic accounting: cash inflows must exceed cash outflows. Run your household and business like a going concern and manage it sensibly. Make spending cuts on things you can do without and fight like the dickens to capitalize on any and all tax strategies you can justify. Getting caught up in the nuances of “Fiscal Cliff” or any other fear of the day is a waste of time. But recognizing that the “cliff” is just like Y2K and SARS (ie: nothing perilous is going to happen to you) is helpful for our collective piece of mind this Holiday season. You are the kings and queens of your own kingdoms. Act accordingly. -D. Scott Bloom, CFP CERTIFIED FINANCIAL PLANNER™ LPL FINANCIAL Member FINRA/SIPC The opinions voiced in this material are for general information purposes only and not intended to provide specific investment advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful. |

D. Scott Bloom, CFP®

|

RSS Feed

RSS Feed