The Law of supply and demand will save us from doom if not at least help us understand why consumption matters so much to the economy and its general health. This is an iScott truism.

There is a widespread debate happening in this country which paints a very dire and gloomy picture for our future, mostly blaming ‘out-of-control’ spending and an overly-politicized “fiscal cliff”. While we dohave a chronic accounting problem with our government, it is not the crisis so many are claiming.

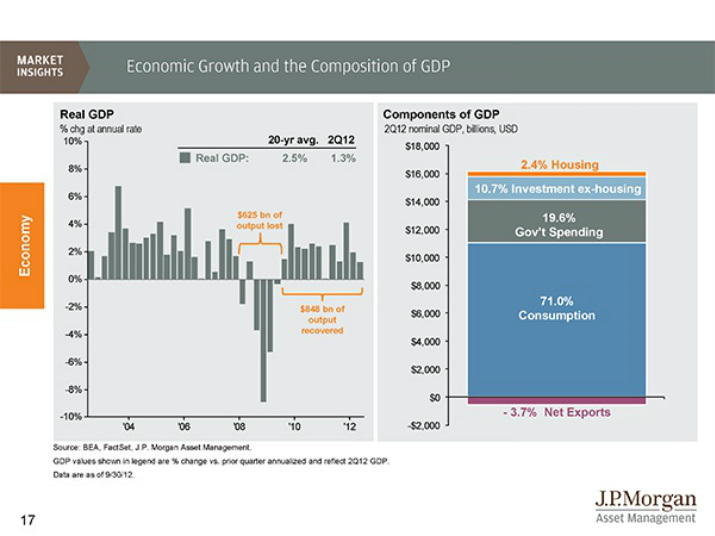

We, as consumers, account for 71% of the US economy1. That means all of the energy, food and discretionary items we ‘demand’ for our lives is meaningful in comparison to the “demands” of the US Treasury. Total federal

spending (including defense and entitlements) accounts for 19.6% of our economy. While this number has grown from the mid-teens in the past two decades, it is still dwarfed by “our” number (71%).

We outspend the government by more than 3-1. That puts us in the lead and makes us the driver of economic growth. Amateur economists an pessimists alike will find every reason to compel us to believe that the government’s problem sends our economy off a sudden cliff. iScott contends they are misguided. Instead, the government’s accounting problem simply flattens our inherently sloped growth trajectory, if not turning it slightly downward on an intermediate term basis.

iScott.net is designed to provide interested readers with alternate perspectives of mainstream media’s agenda.

-D. Scott Bloom, CFP ®

CERTIFIED FINANCIAL PLANNER™

LPL Financial Member FINRA / SIPC

1 Sources: Bureau of Economic Analysis, FACTSET, JP Morgan Asset Management GDP values shown in legend are % change vs. prior quarter annualized and reflect 2Q12 GDP.

The opinions voiced in this material are for general information purposes only and not intended to provide specific investment advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

There is a widespread debate happening in this country which paints a very dire and gloomy picture for our future, mostly blaming ‘out-of-control’ spending and an overly-politicized “fiscal cliff”. While we dohave a chronic accounting problem with our government, it is not the crisis so many are claiming.

We, as consumers, account for 71% of the US economy1. That means all of the energy, food and discretionary items we ‘demand’ for our lives is meaningful in comparison to the “demands” of the US Treasury. Total federal

spending (including defense and entitlements) accounts for 19.6% of our economy. While this number has grown from the mid-teens in the past two decades, it is still dwarfed by “our” number (71%).

We outspend the government by more than 3-1. That puts us in the lead and makes us the driver of economic growth. Amateur economists an pessimists alike will find every reason to compel us to believe that the government’s problem sends our economy off a sudden cliff. iScott contends they are misguided. Instead, the government’s accounting problem simply flattens our inherently sloped growth trajectory, if not turning it slightly downward on an intermediate term basis.

iScott.net is designed to provide interested readers with alternate perspectives of mainstream media’s agenda.

-D. Scott Bloom, CFP ®

CERTIFIED FINANCIAL PLANNER™

LPL Financial Member FINRA / SIPC

1 Sources: Bureau of Economic Analysis, FACTSET, JP Morgan Asset Management GDP values shown in legend are % change vs. prior quarter annualized and reflect 2Q12 GDP.

The opinions voiced in this material are for general information purposes only and not intended to provide specific investment advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

RSS Feed

RSS Feed