The general public seems fooled into believing we can (or should try to) predict where markets, politics and economies are headed in the short and mid term. People who claim to stay well informed seemed tricked and trapped into believing they have the tools and a basis for predicting outcomes- of elections, markets and economies. Instead, most of us should, but fail to, focus on predicting our own behavioral patterns. I can look at this as a tragedy or an opportunity. To me, this is very low lying fruit and presents enormous opportunity.

So instead of going out on a limb, as I have in the past, and share my market forecast for the coming year, I’d be more wise (and likely accurate) to forecast what the average investor will say and do, especially in the wake of the past 3 months market correction. “Wait and see.”

Wait to see what happens. Wait until the uncertainty goes away. Wait for a safer time to decide.

The markets are virtually impossible to predict with any reliability. There is no evidence to refute this. The same can be said about the the economy, vis a vie Gross Domestic Product (GDP). There are no models or proven algorithms that have accurately predicted what will happen with markets and economies. We might all admit that we are often surprised by the outcomes and results of both. This is the nature of opportunity and risk. The past few years have revealed great proof of this.

What is much more predictable and worth paying attention to is human behavior, and namely, our own patterns of recurring behaviors when it comes to money and investing. This is what 2 decades of advising private clients has taught me to focus on. The practice of studying recurring patterns of predictable behaviors is also a tenet in the field of behavioral finance (aka behavioral economics). This helps explain why many people "buy high and sell low" and also why the pain of losing 10% hurts twice as much as the joy of gaining 10% feels good.

This is important to us right now BECAUSE it helps us choose what we shall pay attention to. It takes strict discipline that many, if not most, of us lack. When we realize that paying closer attention to others and, most importantly, to ourselves, we can see the conundrum of trying to predict market outcomes and get stuck in this trap. Most people I have observed (including myself at times) seem to waste time and energy trying to process information (basically the news) and formulate opinions of the next move in the markets and economies. Take election results for example. We are often tricked into thinking the polls are accurate. Forget for a moment whether polls are accurate or not on any given day. what is important is how we are led (or tricked into) believing polls are reliable. The same conclusion can be drawn with market predictions and the media trying to sway public opinion. I would like to see some very pessimistic commentators making huge personal bets against the markets to support their opinions- but they do not put their money where their mouths are.

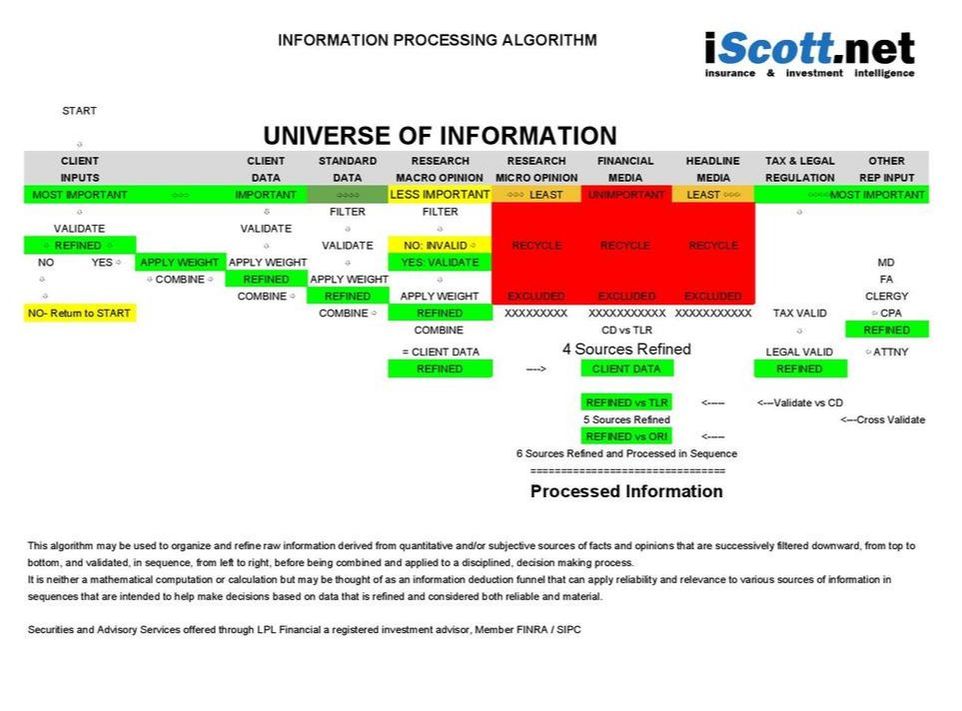

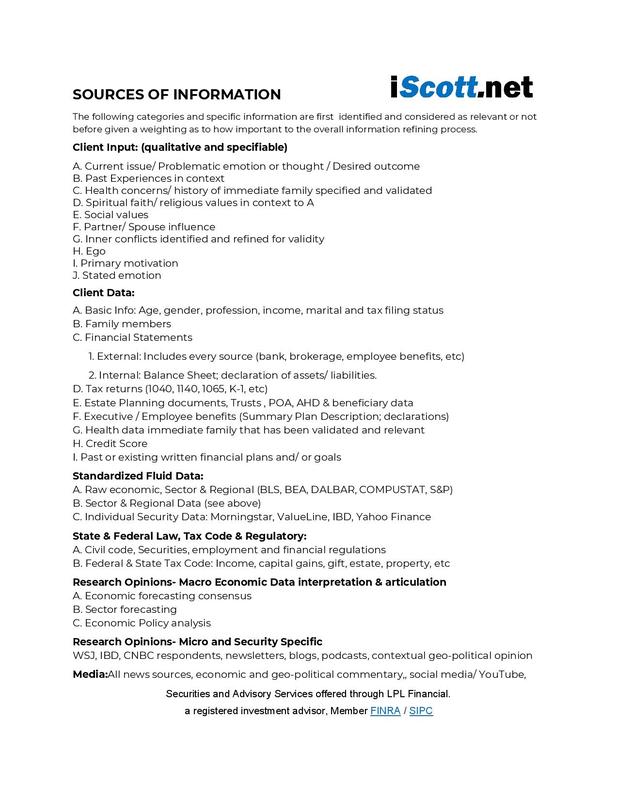

I am extremely optimistic amidst a storm of pessimism and I have my reasons, not the least of which is reliance on the iScott Information Processing Algorithm and the sequential refining of data through it. But, if it were for nothing else, the public’s short attention span, lack of conviction and doubtful confusion from information overload are reliable enough in my view.

Here’s To A Healthy, Happy and Prosperous New Year

D. Scott Bloom, CFP®

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

So instead of going out on a limb, as I have in the past, and share my market forecast for the coming year, I’d be more wise (and likely accurate) to forecast what the average investor will say and do, especially in the wake of the past 3 months market correction. “Wait and see.”

Wait to see what happens. Wait until the uncertainty goes away. Wait for a safer time to decide.

The markets are virtually impossible to predict with any reliability. There is no evidence to refute this. The same can be said about the the economy, vis a vie Gross Domestic Product (GDP). There are no models or proven algorithms that have accurately predicted what will happen with markets and economies. We might all admit that we are often surprised by the outcomes and results of both. This is the nature of opportunity and risk. The past few years have revealed great proof of this.

What is much more predictable and worth paying attention to is human behavior, and namely, our own patterns of recurring behaviors when it comes to money and investing. This is what 2 decades of advising private clients has taught me to focus on. The practice of studying recurring patterns of predictable behaviors is also a tenet in the field of behavioral finance (aka behavioral economics). This helps explain why many people "buy high and sell low" and also why the pain of losing 10% hurts twice as much as the joy of gaining 10% feels good.

This is important to us right now BECAUSE it helps us choose what we shall pay attention to. It takes strict discipline that many, if not most, of us lack. When we realize that paying closer attention to others and, most importantly, to ourselves, we can see the conundrum of trying to predict market outcomes and get stuck in this trap. Most people I have observed (including myself at times) seem to waste time and energy trying to process information (basically the news) and formulate opinions of the next move in the markets and economies. Take election results for example. We are often tricked into thinking the polls are accurate. Forget for a moment whether polls are accurate or not on any given day. what is important is how we are led (or tricked into) believing polls are reliable. The same conclusion can be drawn with market predictions and the media trying to sway public opinion. I would like to see some very pessimistic commentators making huge personal bets against the markets to support their opinions- but they do not put their money where their mouths are.

I am extremely optimistic amidst a storm of pessimism and I have my reasons, not the least of which is reliance on the iScott Information Processing Algorithm and the sequential refining of data through it. But, if it were for nothing else, the public’s short attention span, lack of conviction and doubtful confusion from information overload are reliable enough in my view.

Here’s To A Healthy, Happy and Prosperous New Year

D. Scott Bloom, CFP®

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

RSS Feed

RSS Feed